The WFDSA (World Federation of Direct Selling Associations) has reported recently that the direct selling industry’s sales volume was $189.6 billion in 2017, representing an increase of 1.6% compared to previous year. That is good… but not that good. The global industry’s growth rate had been 6.1% in 2014, 7.6% in 2015, and 1.9% in 2016.

The WFDSA (World Federation of Direct Selling Associations) has reported recently that the direct selling industry’s sales volume was $189.6 billion in 2017, representing an increase of 1.6% compared to previous year. That is good… but not that good. The global industry’s growth rate had been 6.1% in 2014, 7.6% in 2015, and 1.9% in 2016.

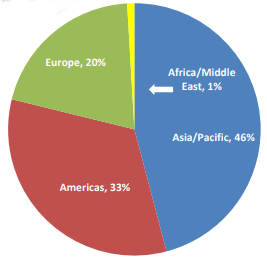

The world federation also estimates that there were more than 116 million direct sellers in the world. 65 million of these were in Asia/Pacific, 33 million in Americas, and 15 million in Europe.

Regions

Out of the five regions the WFDSA divides the world into, Africa & Middle East which is the smallest in volume, came up with the highest growth rate: 9.9%.

Europe followed by 3.5% and Asia/Pacific by 1.8%. The industry in Americas recorded a negative growth in 2017: -1.1%.

The graph on the right shows these regions’ shares in the global volume at the end of 2017. This breakdown has not changed from 2016.

Markets

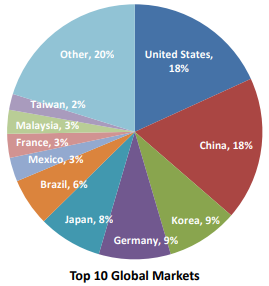

The world’s top 10 direct sales markets are shown on the graph. The only difference from previous year’s Top 10 list was that in 2017, Taiwan replaced the UK to enter the list.

The world’s top 10 direct sales markets are shown on the graph. The only difference from previous year’s Top 10 list was that in 2017, Taiwan replaced the UK to enter the list.

Of this top 10, six had $10 b+ annual sales volume: US, China, Korea, Germany, Japan and Brazil. These six markets generated roughly 70% of the global sales.

From a growth perspective, it is important to note that the industry in the US reported another -1.8% growth in 2017, after the 1.6% decrease in 2016. The second largest market China grew by 3% in 2017. While the size of the US market was $34.9 billion last year, China’s was $34.3 billion.

According to the WFDSA figures, the world’s shining stars in 2017 in terms of volume increases were: Argentina 37%, Indonesia 20%, Turkey 17%, Norway 16%, Romania 15%, United Arab Emirates 15%, Kazakhstan 14%, Russia 13%, Philippines 12%, and Slovenia 12%.

The two markets that reported the worst performances were Netherlands (-14%) and Belgium (-10%).

Product Categories

Wellness category kept its top place last year. Its share was 34%, almost the same what it was in 2016. 32% was cosmetics and personal care’s share in the global direct sales in 2017.This was more than two points up from 2016.

The total share of the largest two product categories was 66%. In other words, about 2/3 of what is being sold through this channel is either cosmetics, personal care or nutritional products. These two categories were the strongest in “Asia/Pacific” where they accounted for 73% of the sales volume.

The third largest category in the world was household goods and durables with 11% share.

This article has aimed at providing a general insight on how the industry performed last year, globally. For more detailed data, you might want to check WFDSA web site.

Note:

WFDSA states in its report that some country figures represent the whole direct sales market, some others represent only the volumes of local DSA members, and some are basically WFDSA estimates. Nevertheless, these reports always give us pretty significant indications.

…..

Hakki Ozmorali is the Principal of WDS Consultancy, a management consulting firm in Canada specialized in providing services to direct selling firms. WDS Consultancy is a proud Supplier Member of the Canada DSA. It is also the publisher of The World of Direct Selling, global industry’s leading weekly online publication since 2010. Hakki is an experienced professional with a strong background in direct sales. His work experiences in direct selling include Country and Regional Manager roles at various multinationals. You can contact Hakki here.

Hakki Ozmorali is the Principal of WDS Consultancy, a management consulting firm in Canada specialized in providing services to direct selling firms. WDS Consultancy is a proud Supplier Member of the Canada DSA. It is also the publisher of The World of Direct Selling, global industry’s leading weekly online publication since 2010. Hakki is an experienced professional with a strong background in direct sales. His work experiences in direct selling include Country and Regional Manager roles at various multinationals. You can contact Hakki here.

SHARE THIS:

Dear Hakki, do you have a similar study only with Latinoamérica markets? or could you share with me where I could find it?

Thanks for your support,

Hi Sandro, you can find them here: https://wfdsa.org/global-statistics/