“Cost multiple” has been a very popular concept in direct selling. For those who are not that familiar with this concept, it is a numerical value showing how much retail sales is to be achieved with “one unit” of product cost.

Direct selling consultant Dan Murphy says in his article The Implications of a Trade War with China on the Direct Selling Industry, “A typical direct selling company in the US markets its products with between 6 to 9 times cost multiple. This cost multiple can be explained in simple math that if a company purchases an item for $10 they charge the end consumer between $60 to $90 dollars for that item. This markup is necessary to support a lucrative compensation plan (usually paying between 40 to 50 percent of each sales dollar) to those that are selling the products, as well as the overhead to manage the business.“

Traditionally, the cost multiple has been one of the first things that entrepreneurs and investors look at when investing in a network marketing business.

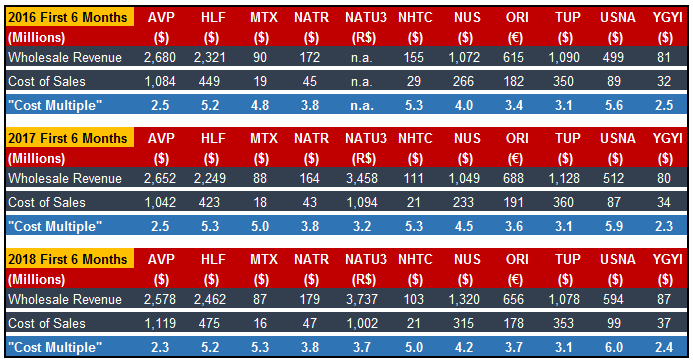

Symbols: AVP= Avon, HLF = Herbalife, MTEX = Mannatech, NATU3= Natura, NATR = Nature’s Sunshine, NHTC = NHT Global, NUS = Nu Skin, ORI = Oriflame, TUP = Tupperware, USNA = USANA, YGYI = Youngevity

This analysis above shows cost multiples from a wholesale revenue perspective, though.

For one thing, we only have reliable, public figures of companies’ wholesale revenues.

Secondly, in many countries, direct selling companies cannot impose the prices that individual direct sellers will sell at. They can only “recommend” them.

Thirdly, direct sellers choose either to sell the products at cost or even give them for free to start a relationship with the customer that could end up with recruiting that person.

Last but not least, we know that in most larger direct selling companies, there is a huge crowd who sign up as distributors merely to be able to purchase the products they like at discounted prices.

This is a controversial issue, on the other hand. The industry has been criticized for a long time for using high mark ups to be able to offer higher commissions to network marketers.

…..

SHARE THIS:

Is there any way to compare with some non-mlm company’s multiples?

Hello Glenn,

You might want to check any public non-direct selling company’s website for its periodical financial reports. There, they publicize all these figures.

Thank you!

Hakki Ozmorali

Thanks Hakki!

How did you determine the cost multiple? I understand what a cost multiple is.

However, are these companies adding things like the shipping cost, warehouse cost, labor, to the cost of the “product”? What about things like rep support cost etc.?

Public companies can justify some of these added cost per item sold and I wonder if that is being added to the actual ingredient and Mfg cost of the product.

Ex: if a product cost two dollars to purchase, is that the cost you used in this multiple? Or may one add another $2 dollars for warehouse, $1 for returns/allowances/bad debt and another $2 for R&D of future products?

I would imagine it’s not very difficult to add cost to the actual product cost to make the cost multiple look smaller than it really is.

So the accounting method may have as much to do with us as the actual mark up?