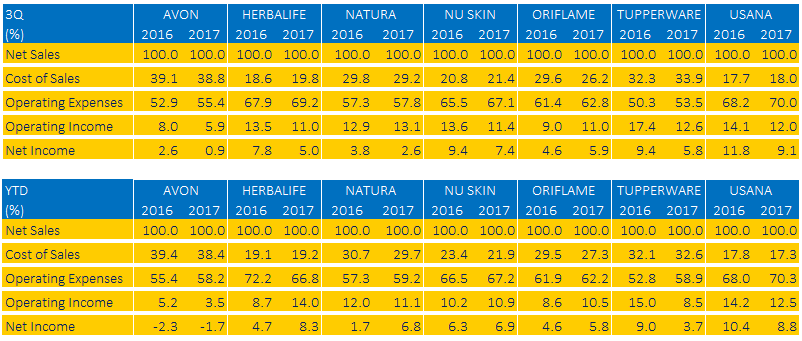

Last week we covered seven of the largest direct selling firms’ third quarter performances from a growth perspective. This time, we will be looking into how they did in costs and consequently, in profits.

Before going into individual company numbers, a few general observations:

* All seven companies report profits for the third quarter. All but Avon have been profitable YTD in 2017, too.

* Herbalife, Nu Skin and USANA have considerably lower costs of sales compared to the other four. Avon is on the other end.

* Although still at a healthy level, Tupperware’s profitability was hurt the most this year.

* Herbalife on the operating income and Natura on the net income side stand out on a YTD basis.

Avon reported 1% quarterly revenue increase that brought it at par with last year’s first nine months. So, Avon has not grown so far this year.

In production costs, we see a slight improvement as it came down by 0.3 points in 3Q and 1 full point in the nine-month period. However, the situation is not bright on Avon’s “selling, general and administrative expenses”. So far this year, this item has gone up to 58.2% from last year’s 55.4%. Avon management attributes this to “higher bad debt and representative, sales leader and field expenses” primarily in Brazil.

Eventually, Avon’s net income for the third quarter was 0.9%. Three quarters combined, Avon reported $70 million loss, down from last year same period’s $97 million.

For the remaining part of the year, Avon expects its modest improvement to continue with flat to positive sales growth relative to last year, but final results to be below full year guidance.

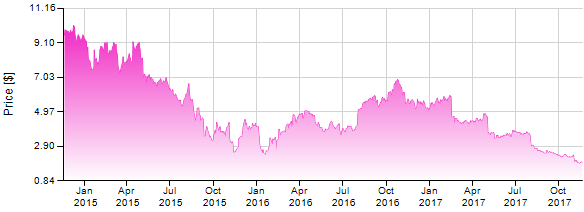

After having reached $6 in February this year, Avon’s share price has come down to as low as $1.85 following 3Q figures. At this price level, Avon’s total value was less than $900 million (had been over $2.6 billion at $6/share).

share price has come down to as low as $1.85 following 3Q figures. At this price level, Avon’s total value was less than $900 million (had been over $2.6 billion at $6/share).

As a side note, the cosmetics giant Coty had made an offer to acquire Avon (included Avon North America or today’s “New Avon“) in 2012 for $10.7 billion. Shortly after this offer was withdrawn, saying Avon had been too reluctant to answer.

In the meanwhile, Chan Galbato, non-executive Chairman of Avon’s Board of Directors said, “The search for a new Chief Executive Officer for Avon is underway. The Board is pleased with the progress and the strong interest we are receiving.”

For more on Avon’s 3Q performance, please click here and here.

![]() Herbalife’s third quarter sales showed a decline of 3.3% as compared to 3Q of 2016. Sales YTD is 3.2% lower than that of last year’s, too.

Herbalife’s third quarter sales showed a decline of 3.3% as compared to 3Q of 2016. Sales YTD is 3.2% lower than that of last year’s, too.

Cost of sales increased from 18.6% to 19.8% in the third quarter. There was a similar increase in company’s operating expenses as well. However, due to the positive performances in the first two quarters of 2017, Herbalife’s YTD operating income and net income figures were much better than last year’s.

Reviewing Herbalife’s cost structure right after Avon’s brings us to an interesting comparison: The wide difference between these two companies’ costs of production (Avon: Nearly 40%, Herbalife: Hardly 20%) as compared to their net sales.

Investors were quite happy with Herbalife’s performance in 2017 until the end of the third quarter. After closing the year 2016 at $48, the price of a Herbalife share went up to $80 in October this year. After the last quarter results, it has been around $65 which is still significantly higher than last year’s closing price. At this price level, Herbalife is valued at close to $6 billion.

For more on Herbalife’s 3Q performance, please click here and here.

Natura’s percentage-wise quarterly cost structure comparison shows a quite steady picture. The only significant difference is in Natura’s net income that declines from 3.8% to 2.6% in 3Q. The company attributes this to The Body Shop acquisition expense.

Natura reported a strong revenue growth in the third quarter  with advances in all its businesses (Natura, Aesop, and The Body Shop): R$ (Brazilian Real) 2.4 billion, up 24% vs. Q3 of 2016, including one-month of revenue from the recently acquired The Body Shop. Excluding this, growth was still double-digit: 11%.

with advances in all its businesses (Natura, Aesop, and The Body Shop): R$ (Brazilian Real) 2.4 billion, up 24% vs. Q3 of 2016, including one-month of revenue from the recently acquired The Body Shop. Excluding this, growth was still double-digit: 11%.

Natura management commented on The Body Shop’s acquisition, saying that:

* The Body Shop’s net revenue in September (the only month within Natura group) increased 1.3% from the year-ago period.

* In the first nine months, they got the initial signs of a recovery, with net revenue growing 2.2%, with the highlights being the U.K, Canada, Asia and e-commerce in the U.S.

After going down to R$19 in September 2016, Natura stock has been in a general upward trend in 2017. Lately, it has been around R$30-32. In 2012 though, it had hit R$50.

For more on Natura’s 3Q performance, please click here.

Third quarter sales of Nu Skin’s was 7% less than 3Q of 2016, although it was still slightly above its initial guidance. Nu skin’s YTD revenue performance was -4%, too.

Both Nu Skin’s cost of sales and operating expense went up in the third quarter, bringing down its operating from 13.6% in 2016 to 11.4% in 2017. The major increase was in its “general and administrative expenses” that went up from 23.3% to 25.4% during the quarter. Content with the 3Q performance, CEO Ritch Wood said, “During the third quarter, we continued to execute our growth strategy and delivered results at the top-end of our previous guidance range.”

Nu Skin shares are being valued at $65-66 these days, meaning the total company value is around $3.5 billion.

For more on Nu Skin’s 3Q performance, please click here and here.

Oriflame reported 6% sales increase in the third quarter, bringing its 2017 nine-month sales to €983 million that is 10% better than 2016’s same period.

Looking from a profitability perspective, Oriflame also reported a significant decrease in its cost of sales (from 29.6% to 26.2%) for the third quarter. Management said this was due to the positive impact received from the price/mix effects and supply chain efficiency measures.

Looking from a profitability perspective, Oriflame also reported a significant decrease in its cost of sales (from 29.6% to 26.2%) for the third quarter. Management said this was due to the positive impact received from the price/mix effects and supply chain efficiency measures.

For the whole of 2017, Oriflame has been more profitable both in terms of operating income and net income so far, on a year-over-year basis.

After reaching an all-time high in at SEK (Swedish Krona) 466 in March 2010, Oriflame share followed a declining trend until September 2015 when it went down to SEK 103. Then, it started picking up and it is now SEK 335-340. Today, Oriflame’s market capitalization is around SEK 19 billion which is approximately $2.3 billion.

For more on Oriflame’s 3Q performance, please click here.

Tupperware’s 3Q sales was up 3% versus last year. Company’s nine-month sales performance was 3% above 2016’s same period, too.

Cost of sales has been in the 32-33% range for two years, but there is a slight increase in 2017. The major increase is in the operating expenses. At the end of the third quarter, this figure was 58.9% of net sales (was 52.8% in last year same period). This was mainly due to two expense items on the income statement: “Re-engineering and impairment charges”, and “impairment of goodwill.” These two exceptional items reduce Tupperware’s both operating income and net income this year.

Tupperware share is being currently traded at around $60. At this price, Tupperware is valued at $3 billion. In December 2013, one Tupperware share was at $96, the year Tupperware’s revenue peaked at $2.672 billion. The highest price Tupperware stock saw in 2017 was $74 and that was in April.

For more on Tupperware’s 3Q performance, please click here and here.

USANA reported 3% quarterly sales increase from last year. This 3% increase meant the company has been growing at the same pace (i.e. 3%) on a nine-month basis, too.

An increase in USANA’s operating expenses (from 68.2% to 70%) hurt its profitability in the third quarter just as it has been so far in 2017. USANA cites investment and IT spending as one of the factors driving this margin compression. The management said this would be resolved and the expected operating income for the fourth quarter was 14%.

USANA became a $1 billion-revenue company in 2016 and it seems it will continue  being one at least this year. It lately has updated its net sales outlook for 2017 upward as $1.030 billion that was the top end of the previous guidance of $1.015 billion.

being one at least this year. It lately has updated its net sales outlook for 2017 upward as $1.030 billion that was the top end of the previous guidance of $1.015 billion.

USANA share has been priced at $65-70 lately. Company’s market capitalization at this level is $1.6-1.7 billion. In August 2015, the share price had peaked at $80.

For more on USANA’s 3Q performance, please click here and here.

…..

Hakki Ozmorali is the Principal of WDS Consultancy, a consulting firm in Canada specialized in providing services to direct selling firms. He is also the publisher of The World of Direct Selling, global industry’s leading weekly online publication. He is an experienced professional with a strong background in direct sales. Hakki was the first corporate professional in the Turkish network marketing industry. His work experiences in direct selling include Country and Regional Manager roles at various multinationals in Turkey and in Canada. You can contact Hakki here.

Hakki Ozmorali is the Principal of WDS Consultancy, a consulting firm in Canada specialized in providing services to direct selling firms. He is also the publisher of The World of Direct Selling, global industry’s leading weekly online publication. He is an experienced professional with a strong background in direct sales. Hakki was the first corporate professional in the Turkish network marketing industry. His work experiences in direct selling include Country and Regional Manager roles at various multinationals in Turkey and in Canada. You can contact Hakki here.

SHARE THIS:

Its amazing news channel in direct selling industry