This week’s featured article is from Daniel Murphy, Co-Founder and Managing Principal of Strategic Choice Partners. Dan has over 30 years of experience holding senior finance and operating roles at TJX, Pepsico, Panera Bread, Princess House and Immunotec. For the last 15 years Dan has served as both a CEO, CFO and COO for two party plans and network marketing company respectively. Currently Dan is a consultant specializing in the direct selling industry. Dan also served as the Treasurer of the Direct Selling Educational Foundation and previously served as the Treasurer for the US Direct Selling Association.

This week’s featured article is from Daniel Murphy, Co-Founder and Managing Principal of Strategic Choice Partners. Dan has over 30 years of experience holding senior finance and operating roles at TJX, Pepsico, Panera Bread, Princess House and Immunotec. For the last 15 years Dan has served as both a CEO, CFO and COO for two party plans and network marketing company respectively. Currently Dan is a consultant specializing in the direct selling industry. Dan also served as the Treasurer of the Direct Selling Educational Foundation and previously served as the Treasurer for the US Direct Selling Association.

Guest Post by Dan Murphy

The Implications of a Trade War with China on the Direct Selling Industry

International trade is an important part of the world economy, especially between the United States and China. The US imports approximately $505 billion of products from China while the US exports approximately $135 billion of goods to China. We are all aware that the United States is taking steps to lower the imbalance of imports and exports, with a goal of protecting US markets from lower cost producing countries.

The Trump administration has to date imposed tariffs on approximately $36 billion with an additional $16 billion coming shortly for a total of $50 billion. These Chinese imports to the United States consist mostly industrial equipment. The Chinese have likewise imposed tariffs on a similar amount of US products, mainly agricultural products as well as steel and aluminum.

In an escalation of trade tensions, the US has threatened to expand tariffs on $200 billion of other imports. Reportedly, tariffs could begin at a 10% rate, and then escalate to 25% of the value of these imports. This new list of imports contain a number of products which US direct selling companies market to Americans. One example on the list is handbags. The timing of these additional tariffs being imposed would be before the end of this year.

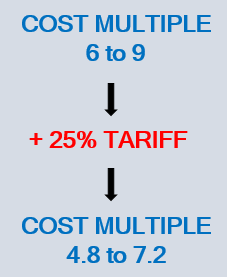

A typical direct selling company in the US markets its products with between  a 6 to 9 times cost multiple. This cost multiple can be explained in simple math that if a company purchases an item for $10 they charge the end consumer between $60 to $90 dollars for that item. This markup is necessary to support a lucrative compensation plan (usually paying between 40 to 50 percent of each sales dollar) to those that are selling the products, as well as the overhead to manage the business. A tariff of 25% would reduce the cost multiple from 6 to 9 down to 4.8 to 7.2. This would cause many sellers of hard goods to, of course, either become unprofitable or to raise prices to consumers by a like amount, effectively passing this bill on to customers. The impact of passing along a 25% price increase to consumers is difficult to gauge but I will take an educated guess that it will not be good.

a 6 to 9 times cost multiple. This cost multiple can be explained in simple math that if a company purchases an item for $10 they charge the end consumer between $60 to $90 dollars for that item. This markup is necessary to support a lucrative compensation plan (usually paying between 40 to 50 percent of each sales dollar) to those that are selling the products, as well as the overhead to manage the business. A tariff of 25% would reduce the cost multiple from 6 to 9 down to 4.8 to 7.2. This would cause many sellers of hard goods to, of course, either become unprofitable or to raise prices to consumers by a like amount, effectively passing this bill on to customers. The impact of passing along a 25% price increase to consumers is difficult to gauge but I will take an educated guess that it will not be good.

As previously stated, the imbalance of trade between the US and China indicates that the US has far more goods that they can impose tariffs on than does China. However there are other tactics that they have at their disposal. China controls the value of its currency. From the period of 2000 to 2018, the value of the Chinese currency (RMB) has steadily fallen from 8.28 to the dollar to 6.49. This decrease in the value of the currency makes the purchase of Chinese products extremely attractive and has been blamed for the current trade imbalance. In the near term, China has the ability to continue to lower the value of the RMB to offset the impact of the US tariffs, effectively negating the efforts of the US.

Another major impact on the direct selling industry is that 10 of the top 25 direct selling companies selling in China are based in the United States. You can probably surmise who they are. In 2017, China was the second largest direct selling market, and by the end of 2018 will certainly be the number one market in the world. With a decreasing value of the RMB, these US firms will see a negative impact when the Chinese currency is converted into US dollars for reporting purposes, creating a currency squeeze.

No matter how you look at it, these trade tensions are not good for the direct selling industry. The next round of tariffs will impact products sold to end consumers who will see higher prices due to what is, in effect, a tax on them. Many of the largest companies in the industry will see declining profits, given that, in many cases, their fastest growing market is China. At the end of the day the best thing would be for negotiations to take place to provide certainty for business in general. However, at this time there are no negotiations taking place.

SHARE THIS: